This New Year Gift Your Loved Ones A Family Health Insurance For Their Well Being

The festivities are in the air as the new year brings the hope of a new beginning. This new year is particularly special because after 2 years of living in a pandemic people are stressing over doing new things and doing them right. With the new year just around the corner, every person is in thought about what gift they can give their loved ones. While it may not be the conventional idea of a new year’s gift, health insurance is definitely one of the most valuable gifts you can give your family.

More Indians have brought life and health insurance in 2020 and 2021 than in five years before. In the current context of the coronavirus epidemic, health insurance is one of the most things to have for yourself and your family. Here are all the ways that online health insurance can help you in the new year:

Fight lifestyle diseases

These days, lifestyle diseases are becoming increasingly prevalent among people under 45 years of age. A sedentary lifestyle, stress, pollution, unhealthy eating habits, gadget addiction and undisciplined life are some of the factors that lead to these diseases.

Following precautionary measures can help combat and manage these diseases. But, in case any illness aggravates, dealing with an unfortunate event can be financially challenging. Investing in a health plan that covers regular medical check-ups can help catch these diseases in advance and make it easy to manage the medical expenses.

*Combat medical inflation

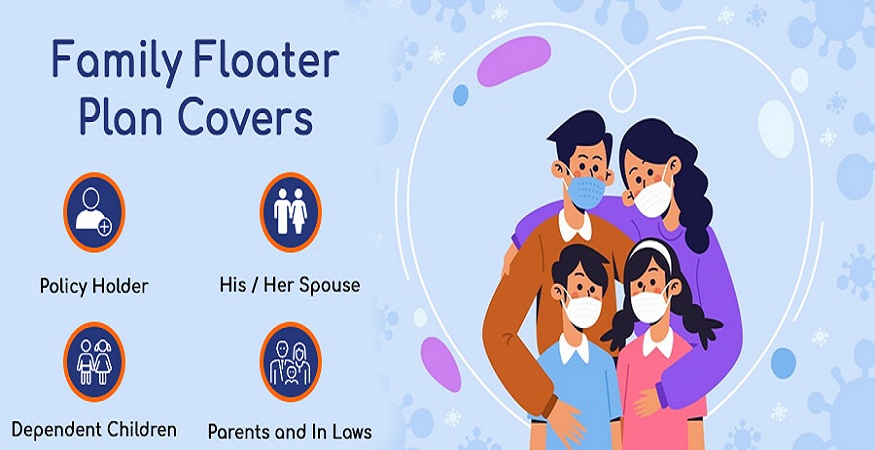

As medical technology advances and diseases increase, so does the cost of treatment. And it is important to understand that medical expenses are not limited to hospitals. The money of medical consultations, diagnostic tests, medications, etc. are also constantly rising. All of these can put a lot of stress on your financial situation if you are not prepared enough. By paying relatively reasonable health insurance premiums each year, you can avoid the burden of medical inflation when choosing a quality treatment, without having to worry about how much it will cost you. Moreover, you have this kind of coverage and benefits for your family with a family floater health insurance policy.

*Protect your savings

Unexpected illness can cause mental anguish and stress, but there is another side to dealing with a health condition that can make you tired – costs. By purchasing an appropriate health insurance policy, you can better manage your medical expenses without losing your savings. Most insurance providers offer cashless treatment, so you do not even have to worry about reimbursement. Your savings can be used for the plans they were intended for such as buying a home, educating your children, and comfortable life during retirement. In addition, health insurance allows you to receive tax benefits, which further increase your savings. Please note that tax benefits are subject to changes in tax laws.

There are many benefits to taking out health insurance as early in life as possible. Because you are young and healthy, you can get low-cost plans and the benefits will continue even as you get older. Additionally, you will be offered more comprehensive coverage options. Most policies have a pre-existing waiting period, which does not include coverage for pre-existing diseases. This period ends when you are still young and healthy, thus giving you the benefit of full coverage, which is useful when you become ill later in life. This is especially important because health insurance for senior citizens can be highly expensive.*

* Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms and conditions, please read sales brochure/policy wording carefully before concluding a sale.